“Three groups spend other people's money: children, thieves, politicians. All three need supervision.” – Dick Armey

Nearly any political boondoggle is possible when you are using other people’s money. There is virtually no social ill, educational challenge, safety hazard or existential environmental crisis that cannot be fixed with enough of it.

In America’s political system, outgoing Presidential administrations commonly shovel OPM out the door in the final weeks of their term. Fearing their “existential” causes will be the immediate target of their political opponent, the outgoing regime too often behaves as if they are on the Titanic and they are throwing gold bars off the edge.

In a December 2023 Pro-Tier post and on numerous podcast appearances since, Doomberg predicted that the 28th annual UN Framework Convention on Climate Change (UNFCCC) “Conference of the Parties” (aka COP28) last December in Dubai would mark the peak in ESG (environmental, social, and governance) and climate hysteria. Today, that call looks prescient.

But the UNFCCC process and the Paris Agreement are not out of gas yet, and at this year’s Greatest Climate Show on Earth™, gargantuan amounts of the world’s economic resources were on the table, with deadlines looming under said Agreement to increase “climate finance.” What happened at COP 29 in Azerbaijan this year? How much more money got thrown on the climate pyre? Let’s explore the beaucoup bucks boondooggle just ended in Baku.

We begin the story with a highly instructive canary in the climate hysteria coal mine (pun intended) about how much of a priority COP29 was not for world “leaders” this year. That we are past peak climate change panic was clearly evident by who did not bother to attend the annual climate circus. The absence of some of the world’s most vocal leaders, many of whom have regularly shrieked “existential climate crisis” while prostrating themselves on the carbon emissions altar, spoke volumes. As Substack energy writer Robert Bryce noted in a post earlier this month:

Need more evidence that the COP meetings are increasingly irrelevant? Here’s a list of world leaders who couldn’t find time in their schedules to fly to Baku:

Japanese Prime Minister Shigeru Ishiba, Chinese President Xi Jinping, Indian Prime Minister Narendra Modi, Brazilian President Luiz Inácio Lula da Silva, German Chancellor Olaf Scholz, US President Joe Biden, Dutch Prime Minister Dick Schoof, and French Prime Minister Emmanuel Macron.

The two most noteworthy developments at COP29 were all about money, not emissions reductions (updated emissions reductions targets are due next year in Belém, Brazil). These included an agreement to triple the amount of “climate finance” for developing countries from $100 billion per year to $300 billion per year by 2035 - and to scale up financing from all public and private sources to $1.3 trillion by 2035 - and an agreement on international carbon credit trading.

Climate finance – the transfer of billions of dollars annually from developed countries “to those less endowed and more vulnerable” developing countries – is an embedded feature of the UNFCCC. Signatories to the Paris Agreement (at COP21 in Paris) committed to provide a mountain of money for developing countries under the auspices of “climate mitigation and adaptation”. The parties’ stated goal was to achieve $100 billion in “climate finance” annually by 2020.

But that $100 billion annual goal was just the beginning. The UNFCCC’s website captures the essence of the aspirational OPM grab (emphasis added):

At COP 21, it was also decided that developed countries intend to continue their existing collective mobilization goal through 2025 in the context of meaningful mitigation actions and transparency on implementation, and that prior to 2025 the Conference of the Parties serving as the meeting of the Parties (CMA) to the Paris Agreement shall set a new collective quantified goal from a floor of USD 100 billion per year, taking into account the needs and priorities of developing countries.

Because 2024 was the last year “prior to 2025”, at COP29 the Conference of the Parties made good on their commitment. But before reviewing the new “climate finance” agreement, let us measure the “Parties’” success against their goal of $100 billion annually by 2020:

It is worth noting that U.S. charities routinely collect more than 80% of the pledges they solicit over the telephone within a matter of weeks. The most successful report collection rates over 90%, despite the fact that, unlike the “Parties” to the Paris Agreement, none of the donors have the ability to print money.

At its core, “climate finance” is an opaque mashup of a) unspoken “reparations” for future “damage” caused by advanced nations’ historic use of hydrocarbon energy to become...advanced, b) funds for climate adaptation, and c) funds for climate mitigation (read: payola for using energy technologies that have the effect of saying to the developing world, “leave your hydrocarbons in the ground and use this “sustainable” tech instead, damn the consequences!”). As we have written in these pages and others have noted, the last of those is a certain path to continued poverty and underdevelopment, ensuring 5 billion or more people never achieve anything close to Western living standards.

To the dismay of many developing nations, $300 billion annually wasn’t enough. Even the commitment to target $1.3 trillion annually in donations and grants starting in 2035 was a concession.

Apparently, distributing an amount equal to the entire GDP of the world’s 47th largest economy (Finland, 2023 GDP US$300.18 billion) or even more than the world’s 17th largest economy (Netherlands, 2023 GDP US$~$1.12 trillion) every year among the developing world is simply insufficient. You can be forgiven for thinking the developing nations have solved all their other problems except for “climate change.”

Chandni Raina, a representative for India's COP 29 delegation said, “We are disappointed in the outcome which clearly brings out the unwillingness of the developed country parties to fulfill their responsibilities." Representatives from other developing nations expressed similar disappointment, if not outrage.

Naturally, President Biden called the new climate finance agreement an “historic outcome,” adding that it:

"Will help mobilize the level of finance – from all sources – that developing countries need to accelerate the transition to clean, sustainable economies, while opening up new markets for American-made electric vehicles, batteries, and other products."

Uh huh. The people in Burundi are just lining up to buy Ford Lightnings.

Whether viewed through the lens of confiscating and redistributing the product of labor and capital, taxpayer expropriations or the printed government fiat of the world’s advanced nations - or better uses of $300 billion to $1.3 trillion annually - this level of “climate finance” has opportunity costs. Sadly, ignorantly, and ironically, the very people purporting to be helped are the ones who are getting hurt the worst.

As a practical matter, $300 billion in annual “climate” funding (rising to $1.3 trillion annually by 2035) for developing nations will not happen because the advanced nations responsible for providing that money are simply not in an economic position to do so. A cursory examination of how those figures relate to the aggregate GDP of the G7 and Organization for Economic Cooperation and Development (OECD) helps frame the scale of the problem.

The graph below shows what the new $300 billion annual public “climate finance” goal, and the $1.3 trillion combined public/private goal, represent as a percentage of the combined GDP of the G7 nations (U.S., Canada, Japan, UK, Germany, France and Italy), and what we will call the “G6” (i.e., all of the above without the U.S.). Our “G6” calculations are relevant given that President-elect Trump has promised to withdraw the U.S. from the Paris Agreement again.

The next graph shows the same goals as a percentage of the combined GDP of the 38 nations that make up the Organization for Economic Cooperation and Development (OECD), and as a percent of the OECD without the U.S. (OECD w/out U.S. GDP):

Considering the hefty portions of the GDP of the G7 and OECD nations that the new Paris Agreement “climate finance” goals represent, it is instructive to note the present fiscal deficits being run by the G7. Meeting the increased goals relies most heavily on these countries. Here we show those figures in billions of US$ as well as a percentage of each nation’s GDP:

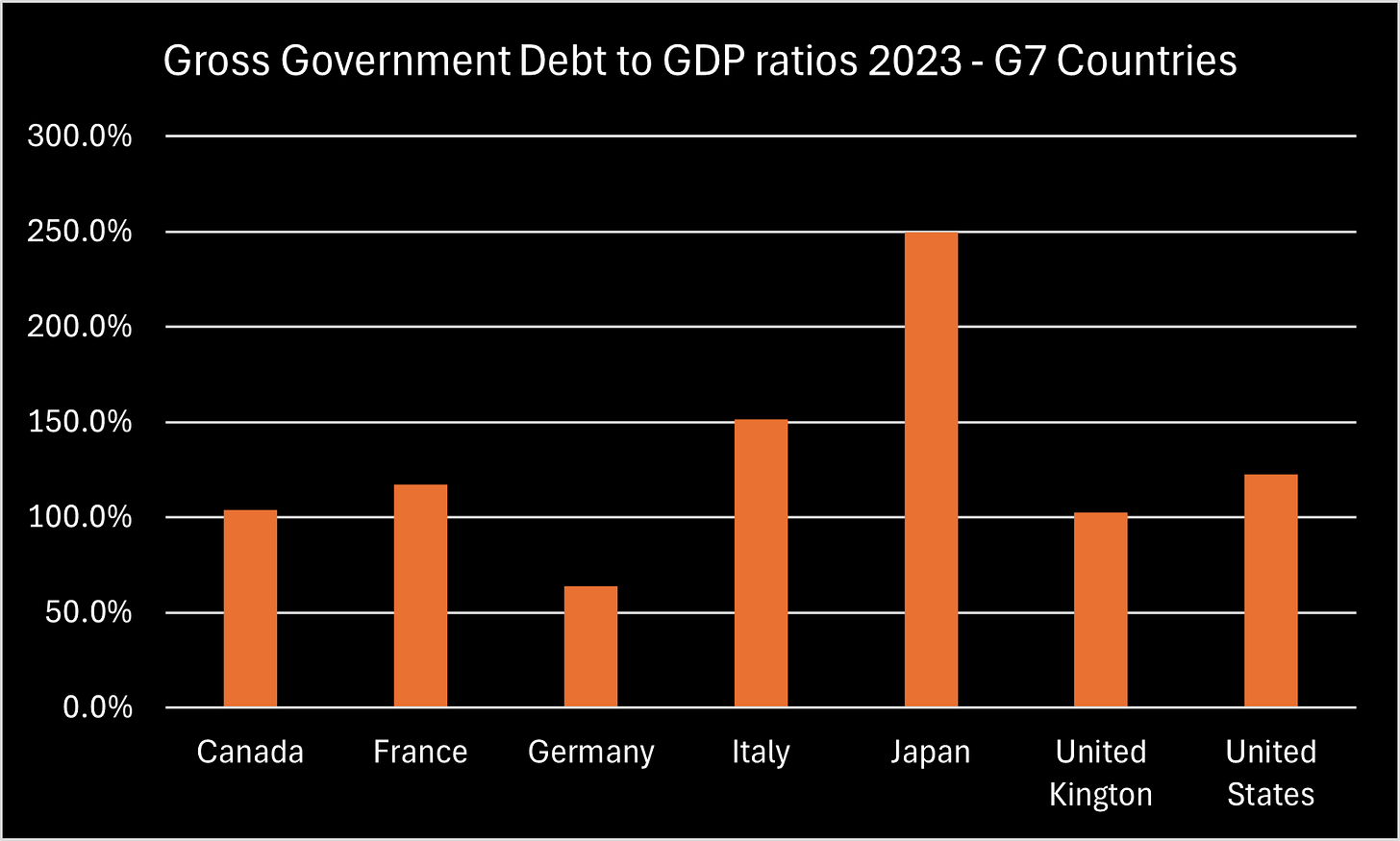

The sovereign debt picture in the G7 nations also provides a sobering yet helpful framing of the “climate finance” goals that emerged from COP29:

Germany is the largest of our “G6” – the remaining G7 nations should the U.S. withdraw from the Paris Agreement - and its lower relative debt and deficit figures would appear to make it the obvious candidate to carry the most weight. But Germany’s economic growth has been severely constrained for many years by its failed “Energiewende,” a term which roughly translates to “a too smart by half, self-inflicted energy suicide.” That trend was made worse after Russia invaded Ukraine, spiking natural gas and electricity prices which hammered the EU’s center of heavy industry. Factory closures, job cuts, industrial corporations moving operations abroad and even divesting operations are ongoing. Closing the last of its nuclear power plants in April 2023 in the midst of a self-inflicted energy crisis only exacerbated the situation.

But long before the Russian invasion of Ukraine, German industrial production was in a prolonged period of low growth, as Brookings Institution Senior Fellow Robin Brooks recently noted on X:

U.S. GDP growth has certainly been fueled by two decades of irresponsible deficit spending, money printing, and the consequent growth in sovereign debt, a responsibility both parties share. But since 2007, the concurrent rapid growth in domestic energy production (read: fracking) set the U.S. up for an economic run that, in retrospect, by comparison to Germany shows just how important energy policy is to a nation’s prosperity:

Given the fiscal condition of the G7, and the “Parties” failure to achieve the initial $100 billion annual “climate finance” goal by 2020, the odds of meeting the $300 billion annual public finance goal by 2035 are low. As such, the odds of achieving the $1.3 trillion annual combined public and private finance goal by 2035 are even lower.

If Trump withdraws the U.S. from the Paris Agreement, we give the remaining G7 and OECD signatories two chances of meeting these goals: Slim and none, and Slim left town on the 4:05 Greyhound to Ft. Worth. Germany, whose industrial sector is historically the source of its economic strength, is the largest remaining economy to shoulder the burden. Given its recent (and ongoing) deindustrialization and current political environment, its chances of carrying the heaviest load are the same.

COP29 may be remembered as the Money COP, and the “Parties” were not done after the historic “climate finance” agreement. After nearly a decade of discussions, in Baku they agreed on key provisions for how carbon markets will operate under Article 6 of the Paris Agreement.

Details about the new carbon market arrangements and carbon credits to be traded are light, and will emerge between now and COP30 in Brazil next fall. But, just like the reaction to the new “climate finance” goals, developing nations were not impressed. Kelly Stone, Climate Land Ambition and Rights Alliance (CLARA) coordinator from ActionAid USA had this to say (emphasis added):

“Nothing in the rules developed here will prevent carbon markets from repeating their history of harming communities and failing to deliver meaningful climate action.

“It is not a coincidence that carbon markets were delivered at what was supposed to be the climate finance COP. When you talk to developed countries about climate finance, they throw up their hands and point to carbon markets and anything other than what’s needed and owed: public finance.”

“Carbon credits” are the modern environmental externality analogue to 15th century Spanish Indulgences imposed by the Catholic church for religious sins, just without the redemption (God may have forgiven, but climate activists still hate you for burning hydrocarbons) and with one other catch: They are almost certainly prone to even more widescale and costly corruption than anything the Church in that era would have attempted to pull off with a straight face.

Whatever the new carbon credit trading scheme turns out to be, it will almost certainly result in higher energy costs in Europe that will further erode international competitiveness, drive heavy industrial users of energy from the bloc, limit economic growth, and further increase electricity costs for consumers. And billions – possibly trillions – in costs for major industrial emitters to launder their CO2 emissions via the new carbon credit trading protocol will have little material impact on Europe’s or the UK’s aggregate CO2 emissions, which in total only represent about 8% of global emissions and have been flat for years anyway.

The existing EU “Emissions Trading Scheme” (celebrating its 20th anniversary next year) has cost European industry €184 billion (US$ 206 billion) just since 2013. For 2023 alone, the levy was €43.6 billion (US$47.1 billion). Returning to our chart comparing the GDP growth of Germany to the U.S. over that period, the consequences of tens of billions of dollars of energy levy burden on one country but not the other seems obvious in retrospect.

We predict that the new international carbon market trading and credits scheme - known as the Paris Agreement Crediting Mechanism – will suffer from the same types of fraud, corruption, questions over “additionality”/materiality and other problems that have plagued carbon offset projects and carbon credit trading thus far. A few examples demonstrate the types of problems the projects, verification entities and market participants can expect to encounter.

Take the case of forest carbon offsets and the carbon offset standards firm Verra. In 2022, The Guardian, the German weekly Die Zeit and SourceMaterial (a non-profit investigative journalism organization) conducted a nine-month investigation into the firm, the world’s leading carbon standard for the $2 billion plus global carbon offset market. A lengthy January 2023 Guardian article about the investigation noted:

“based on analysis of a significant percentage of the projects, that more than 90% of their rainforest offset credits – among the most commonly used by companies – are likely to be “phantom credits” and do not represent genuine carbon reductions. Verra forest carbon offsets purchased by large corporations like Shell, Disney and Gucci are largely “worthless.”

Finite Carbon bills itself as the largest U.S. forest carbon offset company, managing over 60 projects covering some 1.6 million hectares (nearly 4 million acres). Finite Carbon’s offset projects purportedly generate 25% of all U.S. carbon credits.

A satellite analysis by Renoster and CarbonPlan covering three Finite Carbon projects representing carbon credits valued at nearly $350 million determined that about 80% of the credits should not have been issued.

Gaming forestry carbon credits is not a new phenomenon. In a December 2009 press release, Europol announced that the EU ETS had been the victim of fraudulent traders to the tune of ~€5 billion over the prior 18 months. The schemes involved the EU’s “Value Added Tax” (VAT).

Two months ago, Former C-Quest Capital Chief Executive Officer Kenneth Newcombe was indicted on charges of wire fraud and commodities fraud for falsifying emissions-reduction data to secure millions of carbon credits and over $100 million in investments. As a CarbonCredits.com story notes, Kenneth Newcombe played a pivotal role in advancing carbon trading during his tenure at the World Bank. At nearly 77, Newcombe now faces twenty years in prison if convicted of the most serious charges.

In February 2023, European Public Prosecutors Office (EPPO) in Sofia, Bulgaria carried out its own investigation into fraud involving EU ETS credits “with losses of millions of euro to the EU and national budgets.”

These examples merely scratch the surface in the interest of space. A deeper dive into carbon credits, trading and markets may be the topic of a future post. Ironically, in addition to the economic waste and fraud, human rights and ecosystem services also get kicked in the teeth from the entire scheme.

We close returning to something we wrote in our very first Substack post two years ago about the “climate is everything” approach to modern “environmentalism,” and the advanced nations spending ~$5 trillion on “climate change” so far:

“What good could have been done for the lot of humanity worldwide with this amount of money?”

It is well past the time when spending $300 billion - $1.3 trillion each year of advanced nations output pretending that climate adaptation, mitigation, and “renewable” energy are of greater value and higher priority than clean water, malnutrition, basic sanitation and healthcare, education, disease, property rights, affordable/reliable/abundant/on-demand distributed electricity, economic development, conservation and any number of other issues are to the 5+ billion living below our standards. This is a misallocation of resources with real consequences.

As we have previously noted, The Copenhagen Consensus work is an example of twelve more impactful policies (including agriculture, malnutrition, disease, education and others) benefiting the world’s poorest much quicker and at a fraction of the cost. Every policy materially advances one or more of the UN Sustainable Development Goals.

Whether or not The Copenhagen Consensus’ twelve are the right priorities is irrelevant. That other human health and environmental concerns having nothing to do with climate are more pressing and the investments yield greater and more immediate returns matters.

Our rhetorical question that was the genesis of this Substack publication still stands. It would be wise to answer the call and stop making the problem worse.

As we say: “The planet is going to be fine. Worry about the people.”

“Like” this post to win a chance to be our representative at COP30 Brazil

Leave us a comment. We read them all and reply to most. They help fuel our engine.

Subscribe to environMENTAL for free below.

Share this post. It helps us grow and we’re grateful for it.

One prime idiot that will try to meet his commitments is our Trudeau who is never afraid to borrow more money, having accumulated more debt in 9 years than all previous governments together in 148 years of trying.

So we need an election now before he does this

The entire process has been extremely frustrating for many of us to watch as it is clear there is very little substance to their arguments, but a lot of money is available to the entire climate grifters group because they have been effective salesmen for their cause.

It is beyond disturbing that the Biden administration is going to burn more money now, especially since the people of the US has made clear their views.

I'm willing to wager there won't even be` a COP 31