Wikipedia defines colloquialism as “the linguistic style used for casual (informal) communication.” A young, successful Argentine colleague who has lived in America twenty years and worked hard to achieve citizenship still struggles with them, especially some of the real dandies in the South.

Attempt to disguise obvious deficiencies in something with a glossy, attractive outward appearance in the South and someone will inevitably drawl, “that’s just puttin’ lipstick on a pig!”

Proverbs, on the other hand, tend to be more widely understood regardless of geography or language. “You can lead a horse to water, but you can’t make it drink” travels in a way colloquialism usually does not.

We can hardly think of two better phrases to describe the present situation with electric vehicles (EVs). Their CO2 emissions reduction benefits are lipstick on a voracious, industrial mining pig. And despite nearly a decade of lavish subsidies enticing buyers, their adoption rate has suddenly slowed. What is the lipstick hiding? And why have the horses suddenly stopped rushing to the EV well? Let’s cut through the green manure and have a look.

We begin with a brief overview of the supposed planet-saving benefits of EVs versus traditional internal combustion engine (ICE) vehicles. EVs emit no CO2, or primary air pollutants that contribute to issues like asthma or respiratory impairment, during their operation. Beyond that, their environmental “benefits” quickly get murky.

Every form of energy we use involves tradeoffs, and all have environmental costs and consequences. The choice between internal combustion and electric power trains in vehicles is no exception.

CO2 Emissions

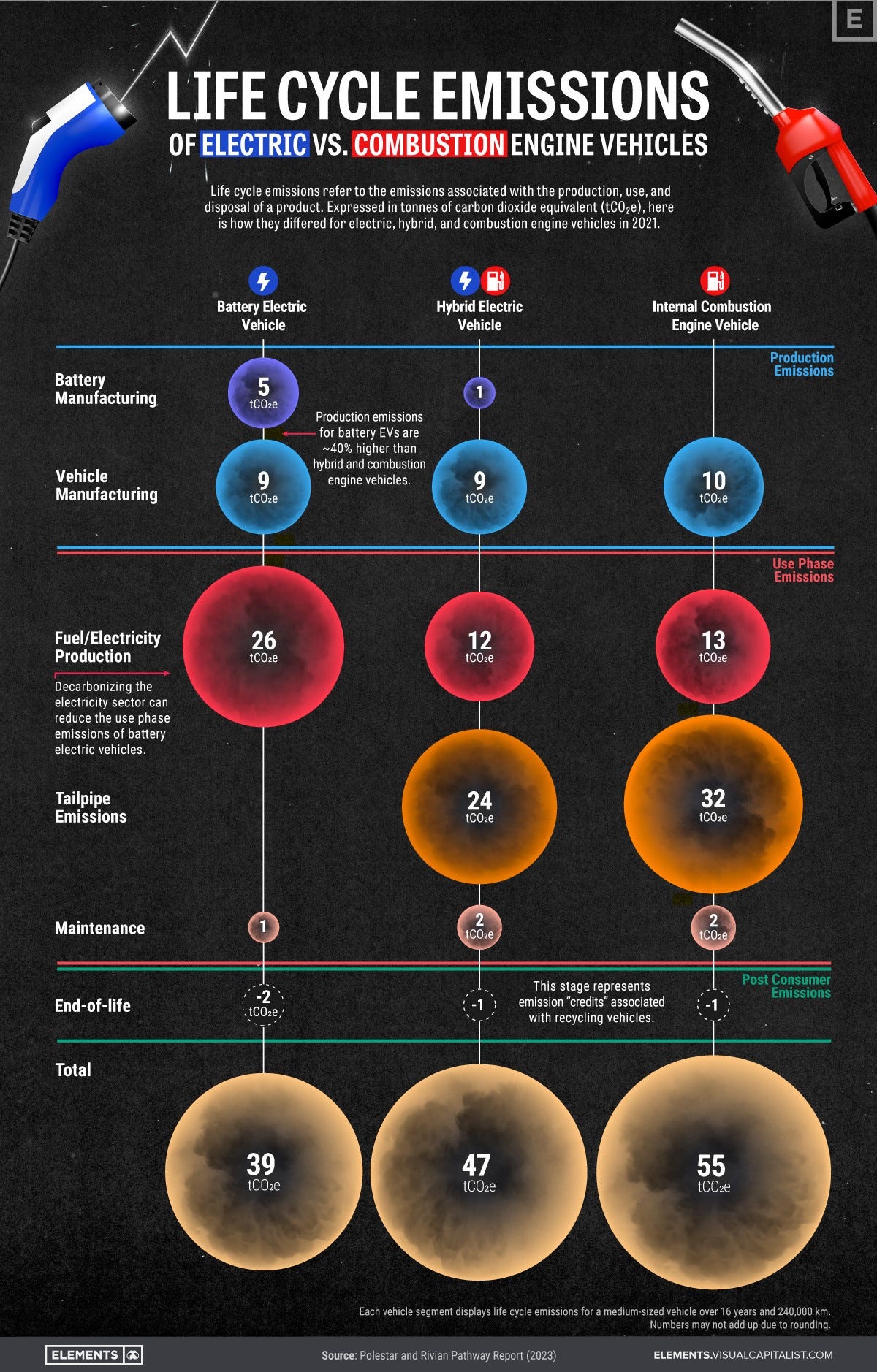

It is too easy to look exclusively at CO2 emissions reductions from the operation of EVs versus ICE vehicles. This conveniently ignores the “well to wheel” CO2 lifecycle emissions from their production as well as geographic differences in the specific fuel sources of the electricity used to charge them. What has been sold to the public as dramatic differences in CO2 emissions reductions get narrowed when accounting for these more granular realities.

EVs are hyped as “zero emissions” by manufacturers, “environmentalists” and Charlatacians™. No “zero emissions” vehicle has ever been manufactured on planet earth, and none ever will.

Resource extraction, processing, engine and component manufacturing, and assembly all use copious amounts of energy. Most of the resource extraction and transportation to processing plants uses diesel fuel. Automotive component manufacturing and assembly plants use fossil fuels ranging from coking coal to natural gas to grid electricity to make their various parts and assemble EVs.

Visual Capitalist provides an excellent visualization of the estimated lifecycle CO2 emissions differences between EVs and ICEs. The comparison assumes a 150,000-mile life for each type of vehicle, or 12.5 years at an average of 12,000 miles per year. It is not obvious to us that most EV batteries will last that long.

Comparing V8 gas engines with low kilowatt hour (KWh) EV battery models, and vice versa, dramatically changes the comparison. But so does where you charge your EV.

In 2023, the top 10 states in EV registrations were California, Florida, Texas, Washington, New Jersey, New York, Illinois, Georgia, Arizona, and Colorado. The table below shows the portion of each state’s electricity generation derived from fossil fuels (coal and/or natural gas) and nuclear power, using data from the U.S. Energy Information Administration (EIA, May 2024) and the California Energy Commission (which includes CA electricity imports from other states).

Washington is the only state in which EV drivers are consistently beating average CO2 emissions reduction analyses between EVs and ICE vehicles, and hydroelectric power (70% of generation) is the reason, not wind or solar. In every other state, hydrocarbons are still the largest single source of fuel for the electricity used to charge EVs. 80% of the electricity used by Florida EV drivers to charge their vehicles comes from fossil fuels.

Metals and Mining

Setting aside steel and aluminum, EVs require around six times more key minerals than similar class ICE vehicles. The graph below compares several key metals:

Since opening new mines in the U.S. and Europe has become a risky, lengthy, costly, nearly impossible process, most of the mines supplying the critical minerals for EV production are far away from the countries where EVs are purchased.

Hard rock mining is notorious throughout the world as an industry whose activities cause significant environmental impacts. Metals concentrate in tailings, often in enormous impoundments with large earthen dams. Tailings pond dam failures are common, and when they occur cause significant downstream contamination of watersheds. Tragically, tailings dam failures in the developing world often result in loss of life as well.

Acid mine drainage from exposed rock weathering also pollutes watersheds. All of these byproducts of hard rock mining leave large swaths of land impacted. In North America, billions are spent each year on hard rock mine reclamation, management of tailings ponds, and managing acid mine drainage. Some of the largest and most problematic U.S. “Superfund” sites (deemed highest threats to human health and the environment) are mining sites, like the Iron Mountain Superfund site near Redding, California, pictured below.

But in other parts of the world, particularly the global south where mining has a less than stellar track record, absence of strict environmental regulations has led to incidents like one in Brazil noted in this February 2023 Bloomberg story. There, a bauxite mine and a nearby processing plant that have been connected to Ford’s F-150 Lightning EV pickup truck supply chain are accused of sickening people with contaminated water from mine and aluminum refining operations.

The “Democratic Republic” of Congo (DRC) has the world’s largest cobalt deposits. Cobalt is a key metal used in electronics, EV batteries, and utility-scale battery storage.

Industrial and “artisan” (code for unregulated) cobalt mining is causing real harm to drinking water and fish and wildlife in DRC. Chinese multinationals operate some of the mines. For a primer on how China uses earth’s environment and atmosphere as its industrial waste site in order to gain competitive advantage over the West - including for the very “green” tech we have mandated - we urge you to read Doomberg’s excellent post Geopollutical Warfare.

The environmental impacts are bad enough. But as Siddharth Kara documented in his book Cobalt Red: How the Blood of the Congo Powers Our Lives, boys as young as twelve have perished tunneling underground for cobalt, often in illegal “artisan” mines.

Indonesia is the world’s largest nickel producer. There, growing demand for nickel used in electronics, EVs and other green tech is helping drive economic growth, but at the cost of deforestation, water quality degradation, and other forms of environmental impairment.

Kalimantan Industrial Park Indonesia (KIPI) is an ambitious effort to move Indonesia up the nickel value chain, from mining to processing and eventually to EV and utility scale battery production. What will power KIPI until a $2 billion+ hydroelectric project can be built (in ten or more years)? A 1.06 gigawatt coal-fired power plant whose total electricity output will be greater than either of the two new nuclear reactors built by Southern Company at Georgia’s Plant Vogtle. All western “environmentalists” should be forced to view the pictures in this Bloomberg story from November 2023.

In the Atacama Desert region of Chile, northwest Argentina, and southwestern Bolivia - one of the driest places on earth – the same environmental story is playing out with lithium. Extremely limited water resources are diverted to lithium mining on the region’s massive salt flats. This negatively impacts water quality and availability for local communities, including Indigenous tribes, wildlife, and ecosystems.

Cobalt mining in DRC, nickel mining in Indonesia and lithium mining in South America’s Atacama Desert region all share an obscured reality: the dirty work of mining to feed the West’s demand for “transition minerals” occurs in the global south, where Americans, Europeans and other western citizens who created the demand do not have to see it. Having made the opening of new mines nearly impossible in all but Australia, western “environmentalists” simply pushed that mining to countries where economic development concerns far outweigh environmental protection.

Pretending environmental degradation incentivized by your “energy transition” policies does not exist is like pretending everyone in the west wants an EV, and all western EV manufacturers are making a killing meeting this demand. Of course, nothing could be further from the truth.

In 2023, the U.S. reached ~1.5 million in new EV sales, up almost 60% over 2022. The ~3 million private passenger battery EVs (not including plug-in or other hybrids) on U.S. roads sounds like a lot, but only account for about 1.2% of all private passenger and light duty vehicles.

Replacing the first 1% of American ICE vehicles was relatively easy, low-hanging fruit. Flashy high-performance EV models were enthusiastically absorbed mostly by tech junkies and green virtue-signaling higher income earners, with more less expensive models like Nissan’s Leaf and similar EVs largely scooped up by dedicated “environmentalists.”

Lavish federal subsidies helped. If you’re a working class, two-income family with kids, you should be pleased to know that for many years your taxes have contributed to federal subsidies of up to $7,500 for wealthy people in Marin County (or Beverly Hills or Manhattan, all of whom were the furthest from needing it) to purchase Tesla’s at $80,000 or more.

And then, in the last year, a funny thing happened. Despite continued federal subsidies and even increased competition among car manufacturers driving down prices, the low-hanging fruit fizzled out.

Forcing the last 98.5% of ICE vehicle drivers to give up their vehicles will be a far harder hill to climb than those wearing green colored lenses would like to admit. EV manufacturer’s financial results for the first half 2024 provided no comfort.

With the lone exception of Tesla (and there only barely) the manufacturers can’t make a profit on EVs. The rest continue to lose their asses even as deliveries grow. As Substack author Robert Bryce is fond of saying “the numbers don’t lie.”

Most of the major manufacturers like GM, Toyota, Nissan, BMW, Volkswagen, and Mercedes do not report their EV results separately. Ford is the lone exception. (Considering their last few years, unless the objective is demonstrating green martyrdom, they may wish to reconsider.)

Financial results from the pure-play EV manufacturers like Tesla, Rivian, Lucid and Fisker are highly instructive. Despite lavish subsidies and manufacturer discounts, the horses they are counting on to drive EV adoption have stopped rushing to drink at the trough.

Robert Bryce has tracked Ford EV losses for the past couple of years on his Substack. As Bryce recently reported, Ford’s $4.7 billion loss on its EV business in 2023 works out to $64,731 on each unit it sold. It recently posted $1.1 billion in losses on its EV line for the second quarter. With 26,000 units sold, the company lost nearly $44,000 on every vehicle sold.

For the first half of 2024, Ford lost almost $2.5 billion selling only 36,000 EVs (23% fewer than the same period in 2023), or more than $68,000 per unit sold. The company stands to lose $5 billion on the business in 2024.

The automaker announced in April that it was delaying the launch of an electric SUV with three-row seating by two years. The vehicle was to be produced at its Oakville Assembly Complex in Ontario, Canada, but the company said it was going to use the facility to build more diesel-powered F-Series Super Duty pickup trucks. In June, Ford said it was delaying by nine months full production of the all-electric Ford F-150 Lightning at its west Tennessee facility.

Tesla reported a 2% increase in its second quarter total revenue compared to a year earlier. And that is about where the good news ended.

Automotive revenue dropped 7% to $19.9 billion for the quarter. The company missed earnings estimates of 62 cents/share by 10 cents (>16%), even after the sale of $890 million in “regulatory credits” (more than triple the $282 million sold in same period in 2023), delivering a whopping 45% drop in net income for the quarter.

For the first half of 2024, Tesla’s total revenue dropped by 3%, its automotive segment revenue dropped by almost 10%, and net income was down by 50%. After missing analysts’ expectations for first quarter vehicle deliveries by the largest margin in seven years (more than 14%), Tesla delivered 444,000 vehicles in the second quarter. With 831,000 total vehicles delivered in the first six months of 2024, Elon Musk’s prediction the company would deliver 1.8 million by the end of 2024 is in serious jeopardy. Discounting vehicles just to achieve the delivery target will only further erode margins.

Rivian reported a 3% increase in revenue in its second quarter this year, and a 9% increase in vehicles delivered (up 1,150 units to 13,790). But for the quarter, Rivian’s net loss of $1.46 billion on revenues of only $1.16 billion represented a 22% deterioration over the same quarter in 2023.

Despite a 33% increase in revenues through six months versus 2023, Rivian’s net losses grew by 14% to nearly $3 billion in the first half of 2024. The loss on the 27,378 vehicles the company delivered through June 30th this year works out to $106,034 each.

Rivian has burned $20 billion since inception, and last year produced fewer than 60,000 vehicles. Amazon, its largest shareholder, ended its exclusive agreement to purchase electric delivery vans from Rivian last November. A disappointing earnings report in February 2023 shaved $1 billion off the value of Amazon’s investment. A picture is worth a thousand words, and this incident at an Amazon center in Houston last month provides an ironically iconic image.

In late February, Volkswagen provided a desperately needed cash infusion, committing to up to $5 billion in debt and equity investments for an EV software joint venture with the firm by 2026.

For Lucid, the good news was that the company delivered 2,394 vehicles in its second quarter (up 70% from the same quarter last year), and revenues were up by about 33%. But with the company still burning around $1 billion every 90 days in expenses, Lucid suffered a net loss of $643 million for the quarter. The good news: that was an improvement of $120 million from the same period in 2023.

For the second quarter, Lucid lost $268,588 per vehicle delivered. Adding its 1,967 deliveries in the first quarter, Lucid’s first half 2024 net loss amounts to $303,000 per unit. (That’s actually an improvement from $430,000 per unit in Lucid’s third quarter 2023, which earned the company a Green Dog Pile trophy for “Beautiful Loser” in our annual 2023 environMENTAL Awards.)

Like Rivian, Lucid has been in obvious need of a cash infusion. Fortunately, the company’s largest investor is the Saudi Public Investment Fund (PIF). There is no shortage of irony in an EV company having to turn to a Petrostate sovereign wealth fund to be bailed out. Nonetheless, in early August, the Saudi PIF committed another $1.5 billion in cash and committed to purchase 100,000 units from a future Lucid plant to be built in Saudi Arabia.

In mid-June, four months after providing “going concern” warnings to investors in February, EV company Fisker filed for bankruptcy, for the second time in 11 years. The 10,000 vehicles Fisker made in 2023 missed its forecast by a wide margin (~75%). Worse, it only delivered about 4,700 of those vehicles. Last month, the company asked a federal bankruptcy judge to approve the sale of ~3,000 of its Ocean electric SUVs to an auto leasing company at the fire sale price of $14,000 per vehicle.

What about EV offerings from General Motors, Porsche, Mercedes, Volkswagen, Jaguar, Land Rover, and Aston Martin? All have announced they are scaling back or delaying EV plans in 2024.

We close by noting that none of this sea of red ink would exist but for U.S. and European government diktats effectively outlawing ICE vehicles due to “climate change” in times frames that are insanely impossible and utterly irresponsible. In the meantime, we have two undeniable situations being exposed despite best efforts to paper over both.

First, hundreds of thousands of pounds of earth’s crust have to be ripped up and processed to obtain the various metals required to make a single EV battery. This has enormous environmental consequences. CO2 emissions reductions associated with EVs are merely lipstick on that pig.

Second, despite lavish subsidies leading the buyers to water, the horses are not drinking as planned. Replacing the first 1% of light duty private passenger cars and trucks was the easy part. The low-hanging fruit buyers are gone, and the red ink just keeps flowing.

In June McKinsey & Co. released its Mobility Consumer Report, which surveys 30,000 vehicle users in 15 countries. 46% of US EV owner respondents said they are likely to switch back to an ICE vehicle for their next purchase. In Australia, the figure was even higher (49%).

Finally, having created EV demand out of thin air through their (insane) energy and environmental policies, the European Commission and U.S. governments are now attempting to protect their domestic automakers from cheap, functional Chinese EVs through tariffs of 100% and higher.

Channeling John Lennon: “and when you went and mandated the EV, all you did was play into the hands of President Xi…”

“Like” this post or we’ll put sugar in your gas tank.

Leave us a comment. They fuel the V8 engine that runs this rig.

Subscribe to environMENTAL for free below.

Share this post. It helps us grow. We’re grateful for that.

I wish I could say I was surprised by any of this but it has been exceedingly obvious that this is how the scenario would play out. Thank you for an excellent description. As I continue to highlight in comments in response to yourselves, Doomberg, Robert Bryce and Meredith Angwin, all of whom produce immensely valuable content, our problem is we continue to think of things in a logical manner and evaluate the data to help make decisions. However, policy makers have no interest in truth or reality, they are playing to an audience that simply wants to feel good about their policies regardless of the ultimate impact. Virtue signaling is their MO, and as long as they are not personally impacted in any negative manner by their decisions, they will not change their ways. The only way to achieve more logical outcomes is to somehow force those policymakers who mandate 50MPG vehicles by next year, or zero emissions for electric power production by 2040, or some other insane timeline that is physically impossible, to suffer the consequences of their actions. so, let's have Minnesota's government buildings run entirely by solar power, cut them off from any fossil fuel power and see how long before they change their minds.

Has anyone done a global analysis of the TOTAL $ invested by all governments and companies to systems to reduce CO2 in the atmosphere over the past 15 years?? I would say it is a good $3-4 TRILLION, probably more. Yet all this investment has done nothing to “bend the curve” to slow CO2 growth. Yes billions of man hours of work, billions of tons of rock moved, Mega Billions of money made (and some lost) in financial instruments. Gee what could have been done with that money and manpower? Improved roads, build schools, train people for real jobs (doctors, engineers, technicians, nurses), build hospitals. But NOOOO! This does not even account for damage to national security by getting trapped with these materials being almost monopolized by China (see https://www.asme.org/topics-resources/content/infographic-electric-vehicles-need-imported-minerals)